Introduction

Cryptocurrency is a digital currency that uses cryptography to secure its transactions and control the creation of new units. It is a decentralized system that does not require intermediaries such as banks, which allows for faster and more efficient transactions. Cryptocurrency has become a popular topic in recent years, as it has the potential to revolutionize the global financial system.

The rise of cryptocurrency has created a new asset class that has caught the attention of investors and financial institutions worldwide. Bitcoin, the first cryptocurrency, was created in 2009, and since then, thousands of other cryptocurrencies have emerged. The total market capitalization of cryptocurrencies has grown exponentially, reaching over $2 trillion in early 2021. This growth has raised important questions about the role of cryptocurrency in global financial markets and its potential impact on the economy.

The importance of this topic is underscored by the increasing interest of investors, regulators, and financial institutions in cryptocurrency. While some see cryptocurrency as a new and innovative technology that can bring about positive changes, others view it as a threat to the existing financial system.

What are global financial markets?

Global financial markets are the networks of financial institutions and markets that facilitate the flow of capital around the world. They include various financial instruments, such as stocks, bonds, currencies, commodities, and derivatives. These markets are critical for companies and governments to raise capital, manage risks, and facilitate international trade.

Types of financial markets

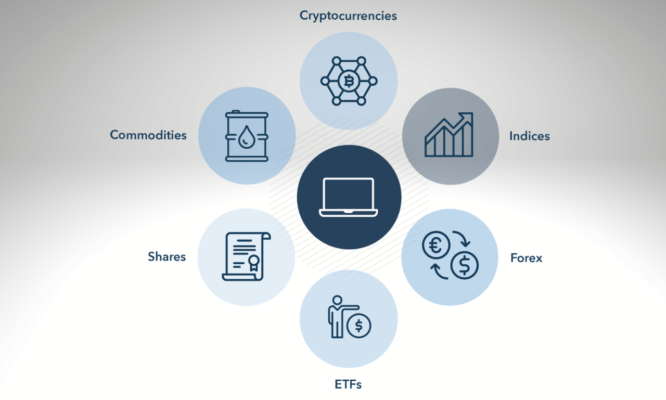

There are several types of financial markets, each with its own unique characteristics and participants. Some of the most common types of financial markets include:

- Stock markets: These markets allow companies to raise capital by selling shares of ownership to investors.

- Bond markets: These markets allow governments and companies to borrow money from investors by issuing bonds.

- Foreign exchange markets: These markets facilitate the exchange of currencies between different countries.

- Commodity markets: These markets allow producers and consumers of commodities to trade goods such as oil, gold, and agricultural products.

- Derivatives markets: These markets allow investors to trade financial instruments whose value is derived from underlying assets, such as stocks or commodities.

Importance of financial markets

Financial markets are crucial for the efficient allocation of capital in the global economy. They allow companies to raise funds for investment, enable investors to earn returns on their investments, and provide a mechanism for managing risk. Financial markets also play a critical role in facilitating international trade by allowing businesses to hedge against currency fluctuations and manage supply chain risks.

How financial markets work

Financial markets operate through a network of institutions, including banks, stock exchanges, and other financial intermediaries. These institutions connect buyers and sellers of financial assets and facilitate the trading and settlement of transactions. Financial markets are also subject to various regulations and oversight by government agencies, which are designed to protect investors and maintain the integrity of the financial system.

Overall, the functioning of global financial markets is complex and interconnected, and their importance cannot be overstated. The evolution of cryptocurrency and blockchain technology has the potential to disrupt and transform these markets, and its impact will be closely watched by investors, regulators, and financial institutions alike.

What is cryptocurrency?

Cryptocurrency is a digital or virtual currency that uses cryptography to secure its transactions and control the creation of new units. It is a decentralized system that operates independently of a central bank or government. Cryptocurrency transactions are recorded on a public ledger known as a blockchain.

How does cryptocurrency work?

Cryptocurrency transactions are validated and recorded on a distributed public ledger known as a blockchain. Each block in the blockchain contains a hash that links it to the previous block, creating an immutable record of all transactions. Cryptocurrency transactions are validated by a network of users who use complex algorithms to solve mathematical problems and confirm the transaction's authenticity.

Types of cryptocurrency

There are several types of cryptocurrency, each with its own unique features and characteristics. Some of the most common types of cryptocurrency include:

- Bitcoin: The first and most well-known cryptocurrency, Bitcoin is a decentralized digital currency that operates independently of a central bank or government.

- Ethereum: Ethereum is a decentralized platform that enables the creation of decentralized applications (dapps) and smart contracts. It also has its own cryptocurrency, called Ether.

- Litecoin: Created in 2011, Litecoin is a decentralized cryptocurrency that uses a different algorithm than Bitcoin to facilitate faster transaction times.

- Ripple: Ripple is a digital payment protocol that enables fast and secure transactions between financial institutions.

- Tether: Tether is a cryptocurrency that is pegged to the value of the US dollar, making it a stablecoin that is less volatile than other cryptocurrencies.

- Binance Coin (BNB): Binance Coin (BNB) is the native cryptocurrency of the Binance exchange platform. Binance Coin has seen significant growth in value and is now considered one of the top cryptocurrencies by market capitalization.

Overall, the emergence of cryptocurrency has revolutionized the way we think about money and the financial system. Its impact on global financial markets and the economy will continue to be closely watched and debated.

Also read: Investing in Cryptocurrency: Benefits, Risks, Best Practices, Exchanges & Buying Guide

The Impact of Cryptocurrency on Global Financial Markets

- Increased market efficiency

One of the most significant impacts of cryptocurrency on global financial markets is its potential to increase market efficiency. Cryptocurrencies use decentralized systems that allow for faster and more efficient transactions. This could reduce the time and costs associated with traditional financial transactions, such as cross-border payments.

- Decentralization of financial systems

Another significant impact of cryptocurrency is its potential to decentralize financial systems. Cryptocurrencies operate independently of central banks and governments, which could reduce the risk of financial crises and increase financial stability. This could also lead to greater financial inclusion, particularly for individuals and businesses underserved by traditional banking systems.

- Reduction in transaction costs

Cryptocurrencies could also reduce transaction costs by eliminating intermediaries such as banks and other financial institutions. This could make financial transactions more accessible and affordable for individuals and businesses, particularly in developing countries where banking infrastructure is limited.

- Reduction in financial fraud

Cryptocurrencies use advanced encryption and security protocols to prevent fraud and protect against hacking. This could reduce the risk of financial fraud and improve the security of financial transactions. Additionally, cryptocurrencies provide greater transparency, making it easier to track and trace transactions.

- Cryptocurrency and international trade

Cryptocurrencies could also have a significant impact on international trade. They could potentially eliminate the need for intermediaries such as banks, reducing the time and costs associated with cross-border payments. This could make it easier and more affordable for businesses to conduct international trade and expand into new markets.

However, cryptocurrencies also pose several challenges and risks to global financial markets, including volatility, lack of regulation, and concerns about their use in illegal activities. It is important for regulators and financial institutions to closely monitor the development of cryptocurrencies and their impact on global financial markets. Overall, the impact of cryptocurrencies on global financial markets remains an area of significant debate and research.

The Potential Future Impact of Cryptocurrency on Global Financial Markets

- Increased regulation

As cryptocurrencies become more widely used and accepted, regulators are likely to increase their oversight and regulation of the industry. This could lead to greater stability and security in the market, but it could also limit the growth and innovation of the industry. Additionally, the lack of uniform regulations across different jurisdictions could create challenges for the global adoption of cryptocurrencies.

- Changes to traditional banking systems

The widespread adoption of cryptocurrencies could fundamentally change the way traditional banking systems operate. Cryptocurrencies could reduce the role of banks as intermediaries and could challenge the traditional banking model. However, it is also possible that traditional banks could adapt to the changing landscape and incorporate cryptocurrency into their existing systems.

- Integration of blockchain technology

The underlying technology behind cryptocurrencies, blockchain, has potential applications in a wide range of industries beyond financial services. Blockchain technology could be used to streamline supply chain management, improve data security, and enhance transparency in a variety of sectors. As such, the integration of blockchain technology could have a significant impact on global financial markets and the wider economy.

Overall, the potential future impact of cryptocurrency on global financial markets is difficult to predict. While the technology has the potential to disrupt traditional financial systems and improve efficiency and transparency, there are also significant challenges and risks associated with its adoption. As the industry continues to evolve, it will be necessary for regulators, financial institutions, and consumers to carefully consider the risks and benefits of cryptocurrencies and to work together to create a stable and secure financial ecosystem.

Challenges to the adoption of cryptocurrency

Despite the potential benefits of cryptocurrency, there are several challenges to its adoption on a large scale. These challenges include limited scalability, security concerns, and a lack of widespread acceptance among consumers and merchants. Additionally, the volatility of cryptocurrencies poses risks to investors and could limit their adoption in mainstream financial markets.

Conclusion

Cryptocurrency has the potential to revolutionize the way we conduct financial transactions and interact with financial systems. However, it is important to carefully consider the risks and benefits of the technology and to work together to create a stable and secure financial ecosystem.

It is likely that cryptocurrency will continue to play an important role in global financial markets in the future, as the technology continues to evolve and mature. However, there are significant challenges and risks associated with the adoption of cryptocurrency, and it will be important for regulators, financial institutions, and consumers to carefully consider these factors.

It is likely that cryptocurrencies will continue to play an important role in global financial markets, particularly as more financial institutions and consumers begin to adopt the technology. However, the success of cryptocurrency will depend on a variety of factors, including regulatory frameworks, technological advancements, and consumer adoption.

Overall, the future of cryptocurrency in global financial markets is uncertain, but technology has the potential to transform the way we think about and interact with financial systems. As such, it is important for individuals, businesses, and governments to stay informed about the latest developments in the industry and to carefully consider the risks and benefits of the technology.